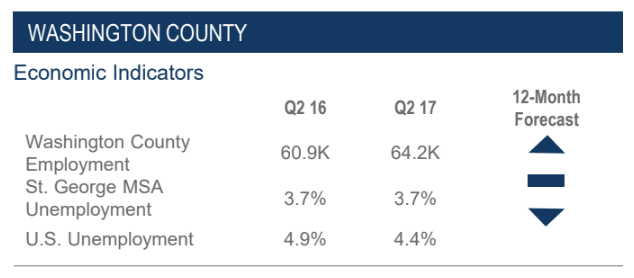

Job growth across the U.S. remained modest as year-to-date growth trailed the same period in 2016. This combined with light growth in GDP caused the Fed to once again hold off on pushing its benchmark interest rates any higher.

Utah added 44,400 net new jobs as job growth increased by 3.2% on a year-over-year basis. Although the unemployment rate increased to 3.8%, this was not the result of weakening in the job market but rather wage growth that has pulled people back into the labor market that was previously sitting on the sidelines.

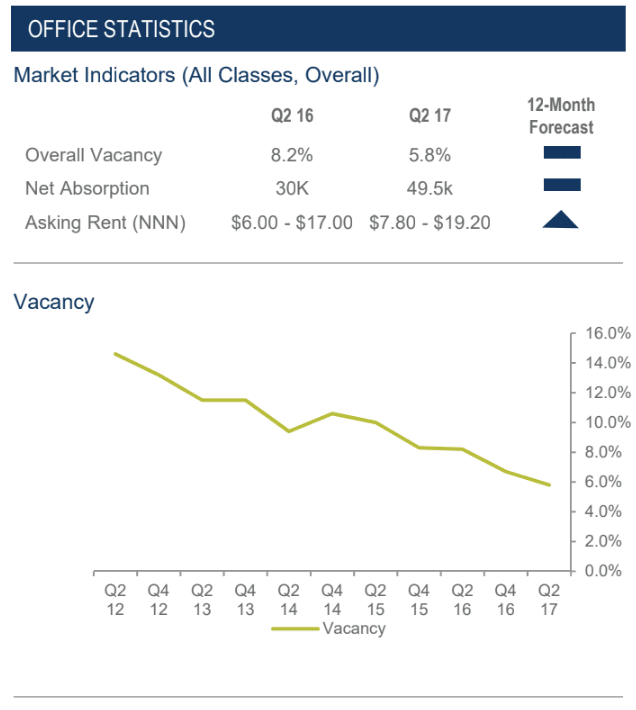

Office Market Overview

The market continued to tighten through the first half of 2017. Vacancy fell to 5.8%, which is the lowest office vacancy rate in the past nine years.

Average asking lease rates bumped up to $1.03/SF NNN, which represents a 4% increase from the end of 2016 and a 10% increase from mid-year 2016.

Dixie Power completed its two new buildings, totaling 29,000 SF. And ground has been broken on a new 57,000 SF medical office building at Riverfront Medical Center.

LINX’s Travis Perry represented the development group in the land acquisition and in the leasing on what is the largest private medical office building ever developed in Washington County and is the first building in a multi-building medical campus.

The prolonged recovery and shrinking vacancy have caused a lack of viable spaces on the market for sale or lease.

This is true, particularly in the Class A sector. Tenant velocity and new lease volume have slowed a result, while pent-up demand is building.

This leasing gridlock has frustrated both landlords and tenants but much more so on the tenant side. These factors are putting upward pressure on rates on prices as buyers and tenants compete for the best spaces in the

market.

Investment activity has slowed from the pace of recent years but is still fairly active. Investment activity has been limited by a lack of investment-grade buildings and tenants much more so than by a lack of investor demand.

We expect the improving trend to accelerate through 2017 with vacancy decreasing and lease rates improving further. Lease rates should increase by another 10-15% over the next 12 months.

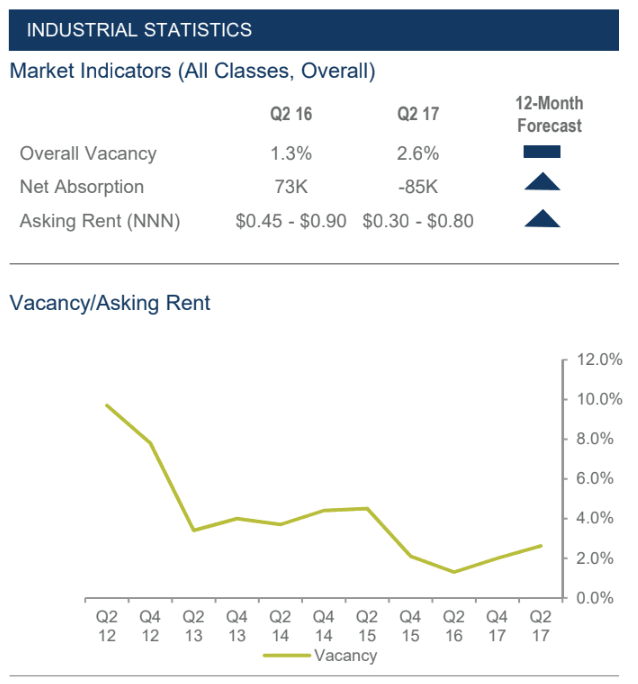

Industrial Market Overview

The industrial market continues to show strength with few available properties on the market for sale or lease.

Vacancy bumped up to 2.59% in the first half of 2017 due in large part to one vacancy of 150,000sf that hit the market over 6 months ago and has yet to be filled.

Without that vacancy, the market would have less than 1% vacancy. Average asking lease rates bumped up to $6.46/SF NNN, which is a 12% increase from the end of 2016.

In exciting news, there is a major spec construction project underway in Ft. Pierce.

Travis Parry, LINX Commercial Real Estate, represented the landlord and tenant in an 80,000sf prelease to a national tenant.

This is the largest new construction industrial lease completed in Washington County since 2008.

A 71,000sf multi-tenant spec building is also under construction on the site and is expected to be completed and available for occupancy in January 2018.

Just over 64,000 sf of new construction was completed in the first half of 2017. Litehouse Foods announced a 180,000sf expansion to its Gateway Industrial site in Hurricane.

Warner Enterprises began construction on a new 100,000sf warehouse in Ft. Pierce and Ram Company broke ground on its 71,000sf expansion.

Investment activity in the industrial market continues to be active, limited only by a lack of availability. Single-tenant and multi-tenant cap rates have been between 7-8% depending on tenant strength and lease terms.

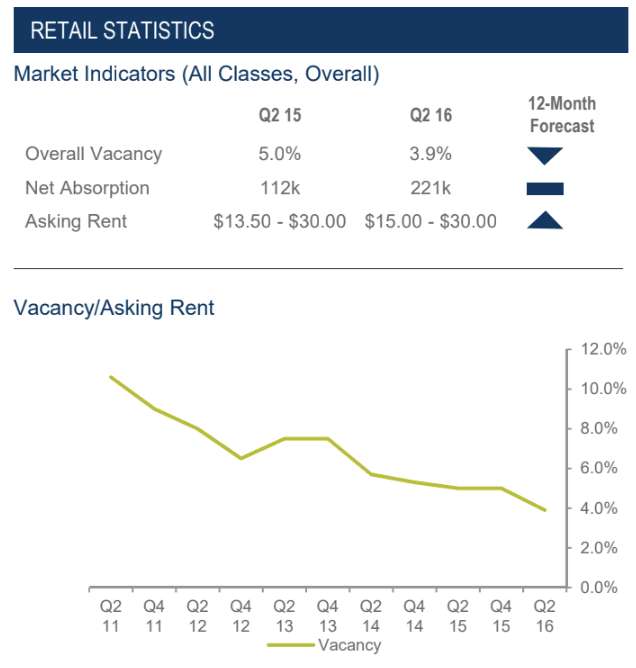

Retail Market Overview

2017 has been a steady year for the retail market. Vacancy held at 2.9% from year-end 2016. New buildings completed in 2017 include:

- Smith’s Marketplace

- The second Tagg-N-Go location on River Road,

- Nielson RV Dealership

- Starbucks on Telegraph and Green Springs Drive

- Tropical Smoothie on Sunset Blvd.

There are several retail projects currently under construction totaling 58,000 sq ft. Numerous restaurants, financial institutions, and neighborhood service companies are negotiating for space around these new centers.

Starbuck’s and Kneaders, newest locations are beginning construction at Dinosaur Crossing. Mountain America broke ground on the corner in front of Lin’s in Washington Fields.

The hotel industry is maybe the most active segment of the market with several projects under construction including:

- The Hyatt Place Lite next to the Dixie Center

- The Hampton inn near Sun River and the Staybridge Suites

- Springhill Suites at Green Springs are pushing for 2017 start

dates.

We have also seen a surge in retail/commercial land sales this year, especially along Interstate 15. We expect retail to attract significant attention again this year with the completion of the grocery-anchored centers and hotels.

Key Lease Transactions 2017

Market Outlook

Office vacancy is expected to decline as activity accelerates through year-end pushing lease rates upward by 5% or more.

Supply constraints within the industrial market will continue into 2017 as new construction tries to keep up with demand. Lease rates are expected to continue climbing.

New construction will continue as grocers, restaurants and other retailers continue to expand in the St. George market.

Vacancy and lease rates for retail are expected to remain steady.

Travis Parry, SIOR, CCIM

Partner – LINX Commercial Real Estate

[email protected]

435-359-4901