Washington County’s commercial market continues to strengthen across all sectors, with retail and office spaces being the biggest vacancy.

The industrial sector stayed under 4%. There has seen very little new construction this year.

Southern Utah continues to improve in the office, retail, and commercial sector.

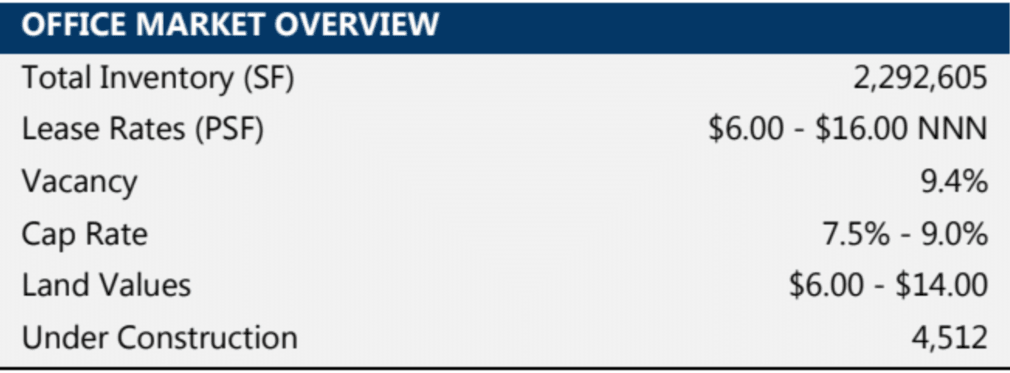

Office Market Overview

Office Market Mid Year 2015

- The vacancy rate is down to 9.4% from 11.5% at year-end 2013

- Average asking lease rates (NNN) increased to $.88psf/mo from $0.82psf/mo a year ago

- 57,492sf of space was absorbed in the first half of 2014

The office market showed noticeable improvement during the first half of 2014. Vacancy dropped two percentage points to 9.4%, and is under 10% for the first time since June 2007.

The average asking lease rates are up modestly. Although lease rates are still relatively low, they are improving at a faster rate this year.

More space was absorbed in the first half of 2014, than in the entire year of 2013.

The Focus Eye Center on River Road (4,512sf), is the only office building currently under construction.

Notable office deals include the 7,741sf first-generation lease for mountain Loan Centers at the Worker’s Compensation Fund building, a 4,000sf lease for Velocity Webworks and a 4,000sf lease for Zion’s Way Hospice.

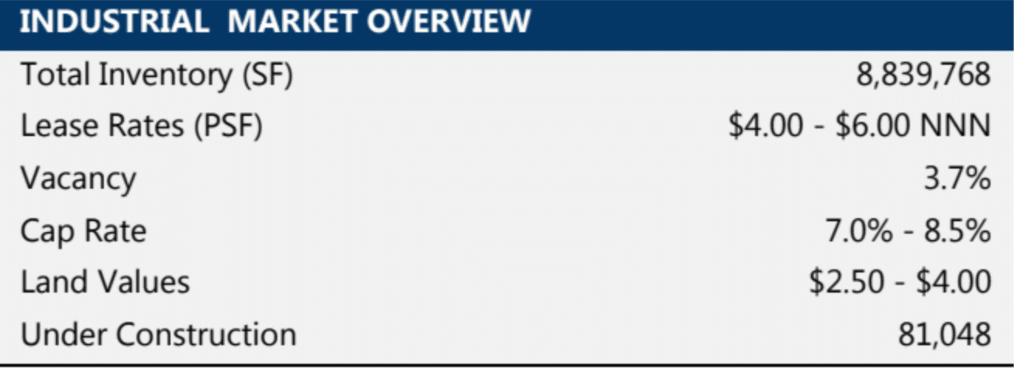

Industrial Market Overview

Industrial Market 2014 Mid-Year Review

- Average asking lease rates are 0.40 to 0.45psf/mo on a NNN basis and are rising.

- New construction will become more significant over the next 6-12 months.

- The vacancy will continue to tighten until new construction brings supply to compensate for demand.

- The acute shortage of large industrial buildings continues as there is no contiguous space over 61,000sf available in the market.

The industrial market continued to be the strongest sector in Washington County, with the vacancy rate dropping slightly to 3.7%.

While the vacancy rate may appear to be just slightly lower over the last six months, looking into the details shows impressive activity. A few larger spaces came back on the market and are skewing the vacancy rate higher.

There are three properties with roughly 50,000sf of vacant space each. If these three buildings were removed from the calculation the vacancy rate would be just 2.5%.

The bulk of the activity in the past six months centers on small to medium spaces.

Notable deals included the new 52,000sf Industrial Brush facility set to open shortly in the Ft. Pierce Industrial Park, a 26,000sf lease by High Country Ammunitions, and a 24,000sf lease for Red Rock Fulfillment.

New Construction started with several smaller industrial buildings, all owner-user, in Ft. Pierce, St. George Industrial Park and the Rio Virgin IndustrialArea.

We expect new construction not only to continue but to increase substantially given the lack of available spaces for lease or purchase in the market.

With the low vacancy, we have seen lease rates continue to rise having come up 20-25% just in the last six months. We expect this trend to continue.

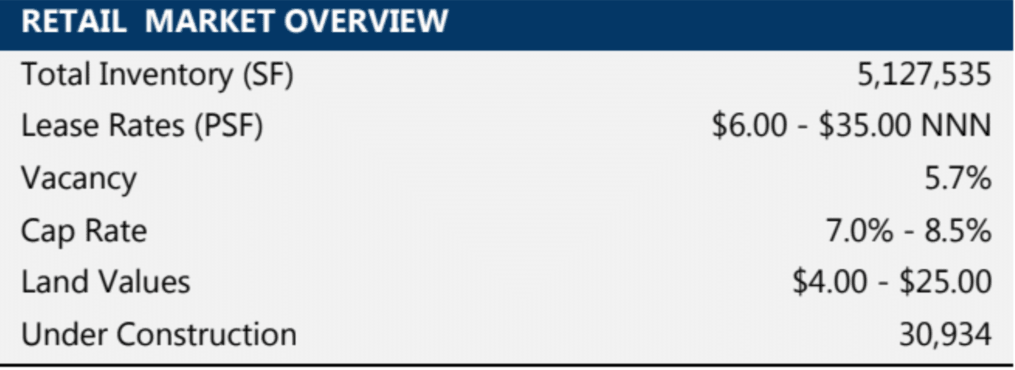

Retail Market Review

Retail Market 2014 Mid-Year Review

- Vacancy fell to 5.7% from 7.5% in the last 6 months.

- Vacancy is expected to drop another 1-1.5 percentage points in the next 6 months.

- Average asking lease rates on class B and C product rose slightly while class A is relatively flat.

- Demand is high for pad site and anchored space.

The retail market has shown solid improvement with nearly a two percentage point reduction in vacancy to 5.7% since year-end 2013.

New construction included the Culvers on Riverside, a new Motozoo, a Dairy Queen on Dixie Drive and a new Maverik on River Road.

Harbor Freight Tools recently opened its doors in the former Big Lots location.

Red Rock Commons is nearly full with only a few small inline spaces remaining.

Café Rio is moving from the Boulevard to Red Rock Commons and Charming Charlie will be opening there this fall.

Kubex, a newer fitness concept, will soon open in the former Bluff St. Staples building.

Market Forecast

We expect the improving trend on all commercial sectors to continue through 2014, with vacancy decreasing lease rates rising.

New construction will increase in retail and industrial, while new office construction will be focused predominately on owner and medical office projects for the time being.

Expect industrial lease rates to continue to jump significantly given the high demand and lack of new construction in the pipeline.

Office lease rates will continue to rise while retail lease rates will hold steady on Class A space and improve solidly on the unanchored class B and C spaces.

Given the rapidly changing conditions in all sectors, owners, developers, and tenants should consider the value of professional brokerage services when contemplating new space.

Travis Parry, SIOR, CCIM

[email protected]

Partner – LINX Commercial Real Estate

435-359-4901