Washington County landlords are looking to brighter days ahead as the office vacancies are at the lowest rates since 2008.

Southern Utah will continue to improve in the office, retail, and industrial sector.

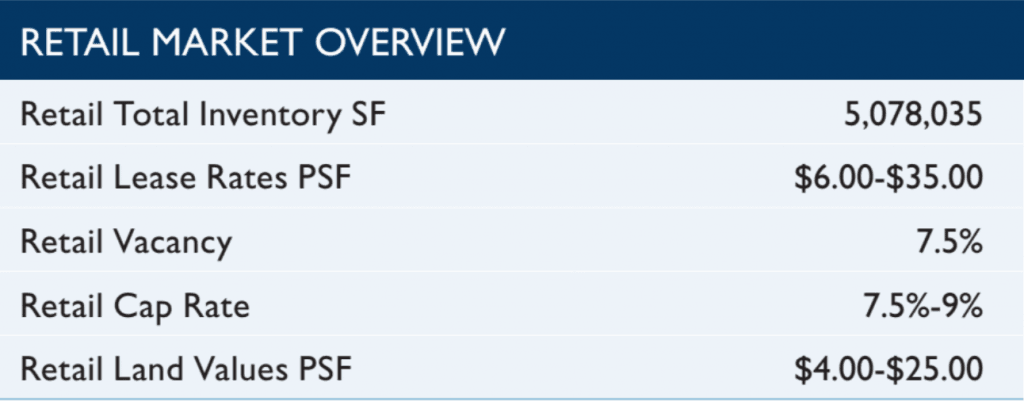

Retail Market 2013 Mid-Year Overview

- The vacancy rate increased by 1.0 percentage points to 7.5%, largely as a result of Big Lots and Office Max vacating just under 50,000 sf

- Average asking lease rates (NNN) increased slightly from $0.82 psf/mo from $0.81 psf/mo at year-end 2012, and from $0.74 psf/mo a year ago

- Absorption has occurred across all property classes

The retail market in Washington County was a mixed bag for the second half of 2013.

Several national retailers expanded with in the market or opened up their first stores during the first half of 2013.

Chick-fil-A opened its first restaurant at Red Rock Commons where they are being joined by Mattress Firm, Einstein Bagels, and Firehouse Subs.

Both Freddy’s Frozen Custard & Steakburgers and Tropical Smoothies Café opened their first stores as well.

Culver’s acquired land just off Riverside Drive and is expected to start construction this fall on its first location in St. George.

Cush-man & Wakefield|Commerce is currently working on a 23-acre retail development located off the new Dixie Drive interchange to include a theater anchor, water park, two hotels, a C-Store and several restaurant pads.

Despite these positive steps in the market, Office Max and Big Lots closed their stores in Washington County over the last six months.

Additionally, Staples announced they will be closing one of their two locations in early 2014.

Office Max and Big Lots added almost 50,000 square feet (sf) of excess space to the market.

When Staples vacates that will add an additional 25,000 sf. While these closings have bumped up the vacancy rate a point, this will be a temporary increase that should decrease over the next 12 months as these spaces are backfilled.

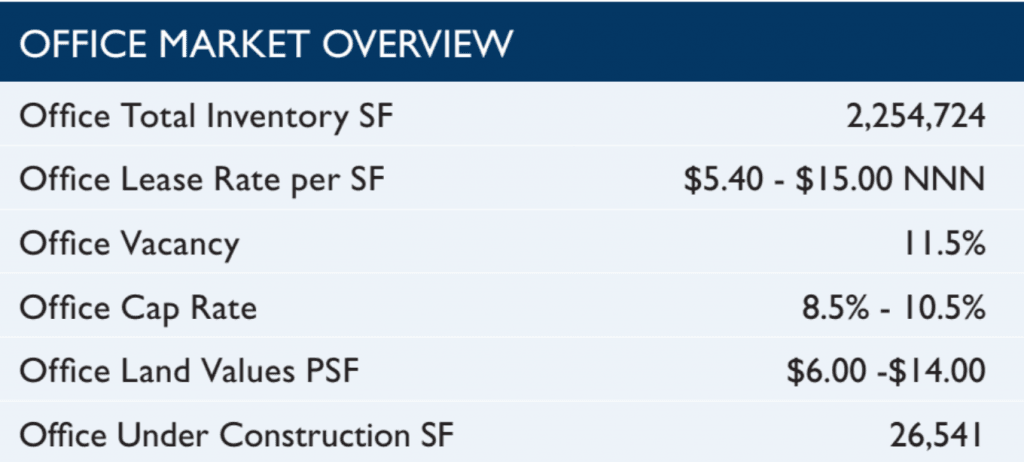

Office Market 2013 Mid-Year Overview

- The vacancy decreased by 1.7 percentage points (pps) to end at 11.5%

- Vacancy has not been under 12% since 2008

- Absorption has occurred across all property classes

- Average asking lease rates improved slightly, continuing an upward trend

- Deal activity has picked up with tenants taking advantage of near all-time-low rates and landlords looking to brighter days ahead

The office market has now shown improvement in three consecutive 6-month periods.

The office vacancy rate has decreased by 1.7 percentage points (pps) since year-end 2012 to the current rate of 11.5%.

The last time the vacancy was under 12.0% was in 2008. This lower vacancy number certainly bodes well for landlords and for the future of the leasing market

Despite strengthening vacancy rates, tenants still have some negotiation power as average asking lease rates remain very close to the all-time lows achieved in 2011.

Deal activity has picked up with tenants taking advantage of near all-time-low rates and landlords looking to brighter days ahead.

Average asking lease rates did show a small increase, nudging up to $0.82 per square foot per month (psf/mo) NNN compared to $0.81 psf/mo NNN at year-end 2012.

Absorption can be seen across all property classes.

As of mid-year 2013, 26,541 sf of office space is under construction. We expect the improving trend to continue through the second half of 2013. As demand for office space outpaces supply, additional positive absorption will continue.

As a result, Landlords will be able to decrease leasing concessions and pushing up asking lease rates.

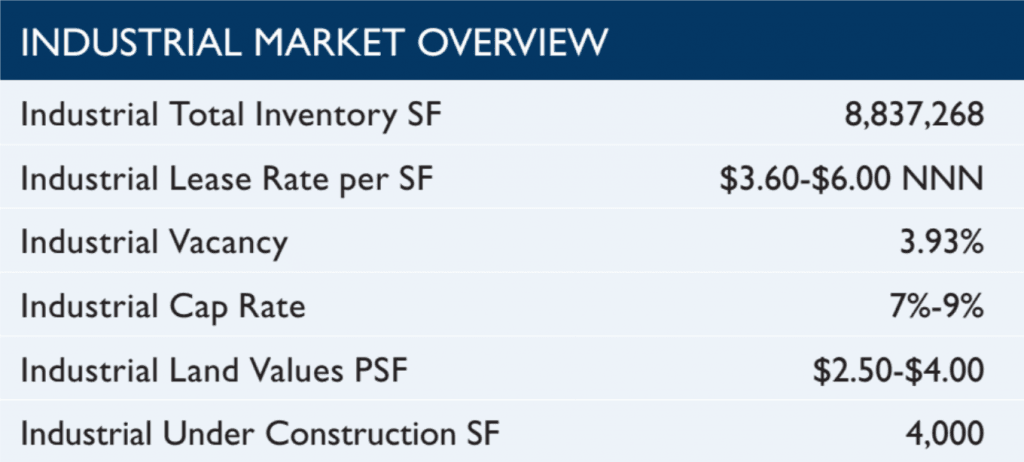

Industrial Market 2013 Mid-Year Overview

- The vacancy rate decreased by nearly 4 pps to end at 3.93%

- The new 850,000 sf Family Dollar Distribution Center in Ft. Pierce Industrial recently opened their doors

- George Fern Exposition & Event Services occupied the former 55,000sf Boulevard Warehouse at 439 N. 3050 E.

- Industrial land sales have picked up with new construction expected during the second half of 2013

- Lease rates are increasing and are expected to rise by 15-20% this year

The industrial market has seen the most activity with the vacancy rate dropping by an impressive 4 percentage points to 3.93% during 2013.

Several notable deals have been completed during 2013 including:

- 850,000 sf Family Dollar Distribution Center

- 85,000 sf lease by Walmart

- 55,000 sf lease by George Fern Exposition & Event Services.

There are currently no vacant spaces larger than 50,000 sf available in the market creating an acute shortage of large available products in the market.

With the tightening market of existing space, we expect new construction to expand during the latter half of this year and into next.

We anticipate lease rates continuing to rise and further bridge the 35-55% differential of current lease rates to break-even lease rates on new construction.

We now have an acute shortage of large, available industrial properties.

We are excited to see the continuing growth in Southern Utah.

If you have specific questions or are looking to buy, sell or lease commercial real estate, call us or check out our new website at linxcre.com.

Travis Parry, SIOR, CCIM

[email protected]

Partner – LINX Commercial Real Estate

435-359-4901